CA FTB 705 2011 free printable template

Show details

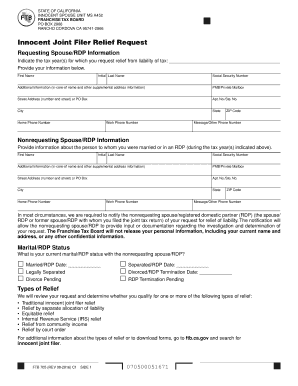

Please make a copy of your completed FTB 705 application and Privacy Notice for your records. FTB 705 Request for Innocent Joint Filer Relief is located on the back cover of this booklet. State of California Franchise Tax Board Innocent Joint Filer Relief From Paying California Income Taxes Inside Injured Spouse Relief PAGE 2 Court-Ordered Relief PAGE 2 Other Ways to Qualify for Relief PAGE 2 FTB 705 PAGE 4 spouse/registered domestic partner...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 705

Edit your CA FTB 705 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 705 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 705 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA FTB 705. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 705 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 705

How to fill out CA FTB 705

01

Obtain the CA FTB 705 form from the California Franchise Tax Board website or a physical location.

02

Fill in the taxpayer’s name as it appears on their tax return.

03

Enter the taxpayer's Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

04

Provide the name and address of the pass-through entity if applicable.

05

Complete the sections related to the taxpayer’s ownership interest in the pass-through entity.

06

Report any income, deductions, credits, or other items related to the pass-through entity.

07

Review the completed form for accuracy and ensure all required signatures are included.

08

Submit the completed form by the due date, either electronically or via mail.

Who needs CA FTB 705?

01

Individuals who are partners in a partnership or shareholders in an S Corporation doing business in California.

02

Taxpayers who receive income, deductions, or credits from pass-through entities.

Fill

form

: Try Risk Free

People Also Ask about

How hard is it to get innocent spouse relief?

You may be able to file for innocent spouse relief. It is not easy to qualify; the IRS receives over 50,000 requests a year but grants less than half. However, innocent spouse relief is determined on a case-by-case basis, so your request will have the same fair hearing as the rest.

What is the innocent spouse rule with the IRS?

Innocent spouse relief relieves you from paying additional federal income tax owed by your spouse due to errors on a joint tax return.

Who qualifies for innocent spouse relief?

You may request innocent spouse relief if: You filed a joint return with your spouse. Your taxes were understated due to errors on your return. You didn't know about the errors.

Can the IRS come after me for my spouse's taxes?

If you file jointly and your spouse has a debt (this can be a federal, state income tax, child support, or spousal support debt) the IRS can apply your refund to one of these debts, which is known as an “offset.” The agency can also take a collection action against you for the tax debt you and your spouse owe, such as

What is the difference between innocent spouse and injured spouse?

There are two types of tax relief for spouses: Injured spouse relief lets you reclaim money taken from your tax refund to cover your spouse's debts. Innocent spouse relief relieves you from paying additional federal income tax owed by your spouse due to errors on a joint tax return.

Do marriages get reported to IRS?

If you're legally married as of December 31 of the tax year, the IRS considers you to be married for the full year. Usually, your only options are to file as either married filing jointly or married filing separately. Using the married filing separately status rarely works to lower a couple's tax bill.

What is Form 705?

FTB 705 - Innocent Joint Filer Relief Request (Relief From Paying California Income Taxes)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in CA FTB 705 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing CA FTB 705 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit CA FTB 705 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing CA FTB 705.

How can I fill out CA FTB 705 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your CA FTB 705. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is CA FTB 705?

CA FTB 705 is the California Franchise Tax Board form used to report income from the sale of personal property or to report transactions that require the reporting of gain or loss for state tax purposes.

Who is required to file CA FTB 705?

Individuals, estates, or trusts that have sold or exchanged personal property such as stocks, bonds, or other investments and have realized a capital gain or loss for California tax purposes are required to file CA FTB 705.

How to fill out CA FTB 705?

To fill out CA FTB 705, taxpayers must provide identification information, details about the transactions including purchase date, sale date, sales price, and cost basis, and calculate the gain or loss according to California tax laws.

What is the purpose of CA FTB 705?

The purpose of CA FTB 705 is to provide the California Franchise Tax Board with accurate information on capital gains and losses from the sale of personal property, ensuring that taxpayers report and pay the correct amount of state taxes.

What information must be reported on CA FTB 705?

The information that must be reported on CA FTB 705 includes the taxpayer's name and identification number, details of each transaction (including dates, amounts, and descriptions), and calculation of the total capital gain or loss for the tax year.

Fill out your CA FTB 705 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 705 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.